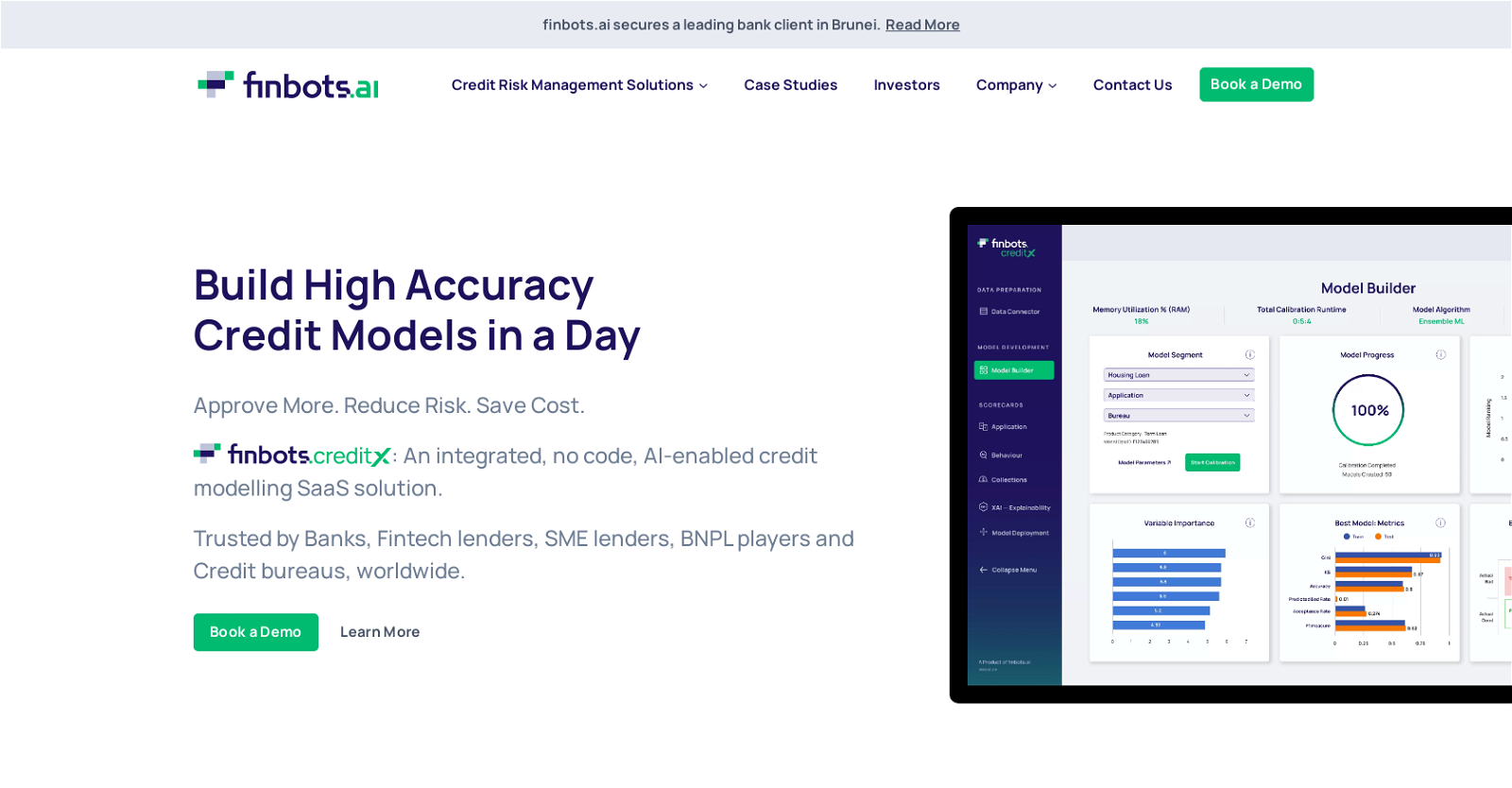

Finbots

Finbots.ai is an integrated, end-to-end, AI-powered credit modelling solution that enables smarter, faster, and more inclusive lending. The tool allows you to build high-accuracy credit models quickly within minutes, reducing risk and saving cost.

It comes with an AI-led SaaS platform that helps you build, validate, and deploy performance-oriented credit models across the full credit lifecycle of applications, behavior, and collections. Finbots.ai tool offers three types of scorecards for credit risk management, including application scorecards, behavior scorecards, and collection scorecards, each designed to assist in minimizing risk and maximizing collections.

The AI algorithms integrated into the platform help you build, validate, and deploy sharper credit models that enable you to approve more loans with less risk. The platform is transparent, fair, and explainable, allowing full control over the decisions made. It operates on five core principles of accuracy, speed, transparency, adaptability, and inclusiveness, making it work seamlessly with the data, workflows, and systems you already have.

The solution has been trusted by banks, fintech lenders, SME lenders, BNPL players, and credit bureaus worldwide. The tool has achieved significant results, with over 25% increase in approvals, 15% decrease in loss rates, and a 20-points increase in GINI. Finbots.ai’s clients can help more customers with more accurate predictions of creditworthiness, providing for better and more inclusive lending practices.

Overall, this tool is a cost-effective, time-saving, and innovative solution for credit risk management in today’s fast-paced lending environment.