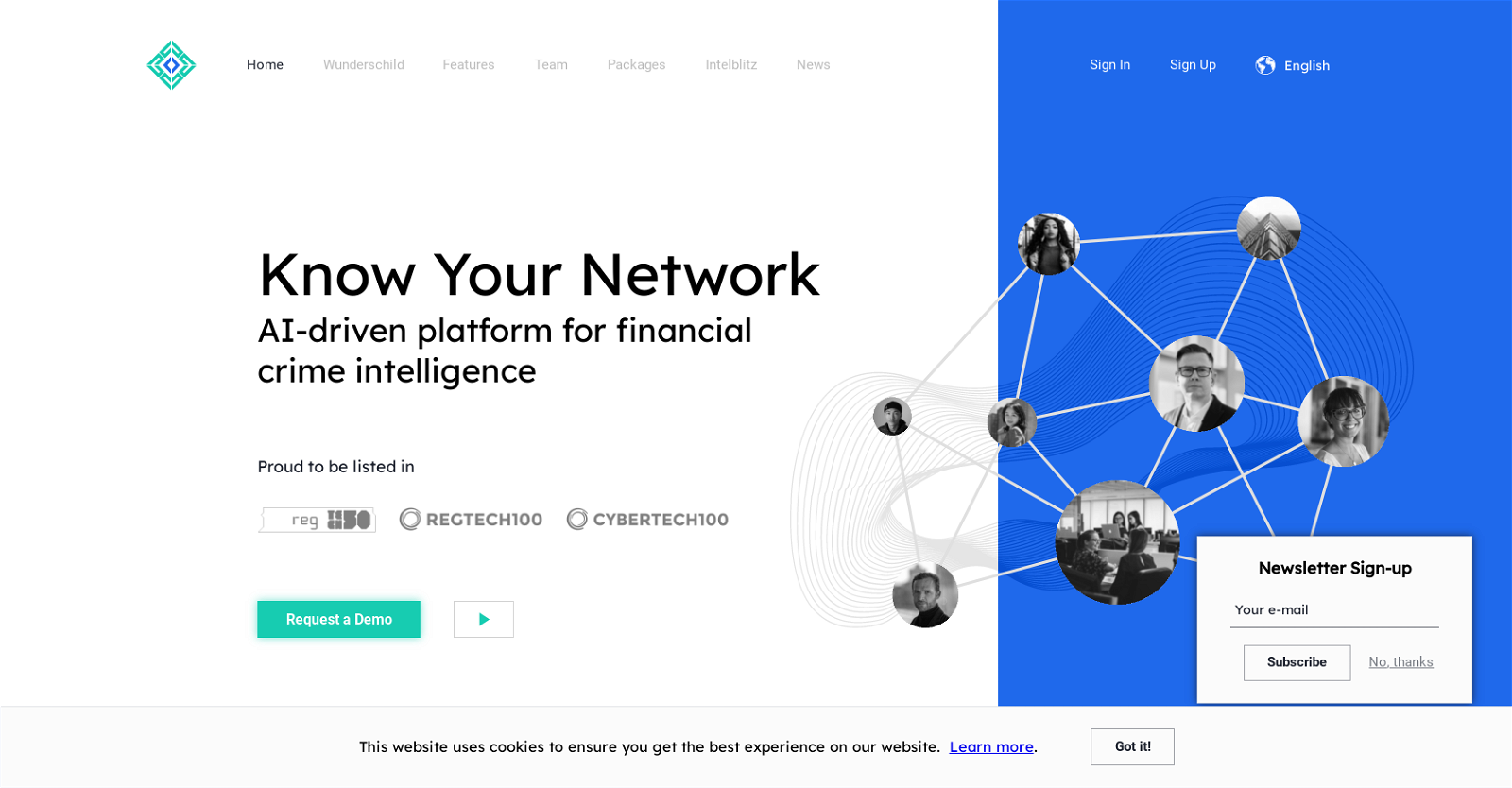

Schwarzthal

Schwarzthal Tech is an AI-driven platform designed for financial crime intelligence. Its expertise and connections bring intelligence solutions based on network assessment, data linkage, flow aggregation, and machine learning to provide insights into strategic risks related to financially motivated crime, money laundering, tax evasion, and fraud.

Schwarzthal Tech’s financial crime platform includes tools for KYC, AML, and VAT as well as tools for tracking carbon fraudsters and future frauds on the energy market. Its features include intelligence, compliance, investigation, media scan, document drill, and transaction monitoring. The platform also offers multi-dimensional risk rating and scoring tools based on semi-supervised learning techniques to enhance compliance functions in a pro-active role.

Schwarzthal Tech’s data backbone is a global business registry enriched with information extracted with advance machine learning techniques, allowing for deep-dives in complex transnational crime cases. Its platform covers the jurisdictions of UK, France, Belgium, Russia, Ireland, Estonia, Kazakhstan, Ukraine, Poland, Panama, and Malta. Schwarzthal Tech is trusted by various organizations, including SFC Capital, Startupbootcamp, London Partners, and the Natwest Group. It is partnered with Neo4j, Cloud Yandex, and Tweezzle. It is a registered product of Schwarzthal Tech and all rights are reserved.