Fontjoy

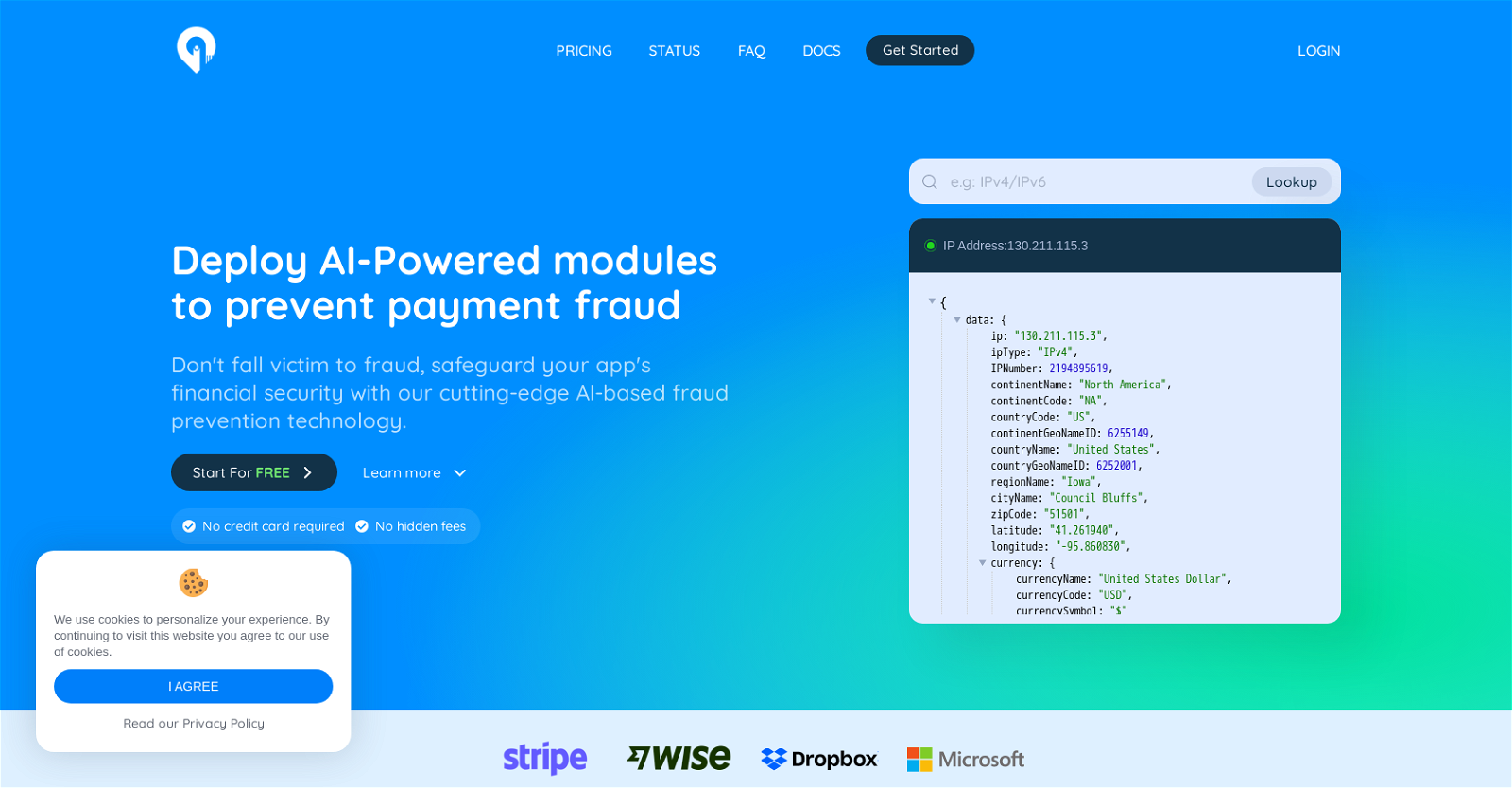

Fontjoy is an AI-powered fraud prevention tool called Greip that helps developers protect their app’s financial security by preventing payment fraud. It utilizes machine learning modules to validate each transaction and assess the likelihood of fraudulent activity. Additionally, Greip incorporates IP geolocation information to enhance the user experience by adapting website content based on visitor location and language.

It effectively detects and safeguards against anonymous visitors and ensures that website visitors are not utilizing VPN or proxy services that could be exploited for fraudulent purposes.

Other notable features of Greip include BIN/IIN validation, country API for comprehensive country information retrieval, user data validation, and more. With various plans available, such as Free, Standard, Premium, and Pay-as-you-go, Greip caters to the diverse needs of developers. Trusted by numerous businesses worldwide, Greip is a project of GRE DEVELOPMENT LTD, registered in England and Wales.

The tool provides extensive resources for developers, including documentation and support, and is accessible as SDKs, packages, and CLI.