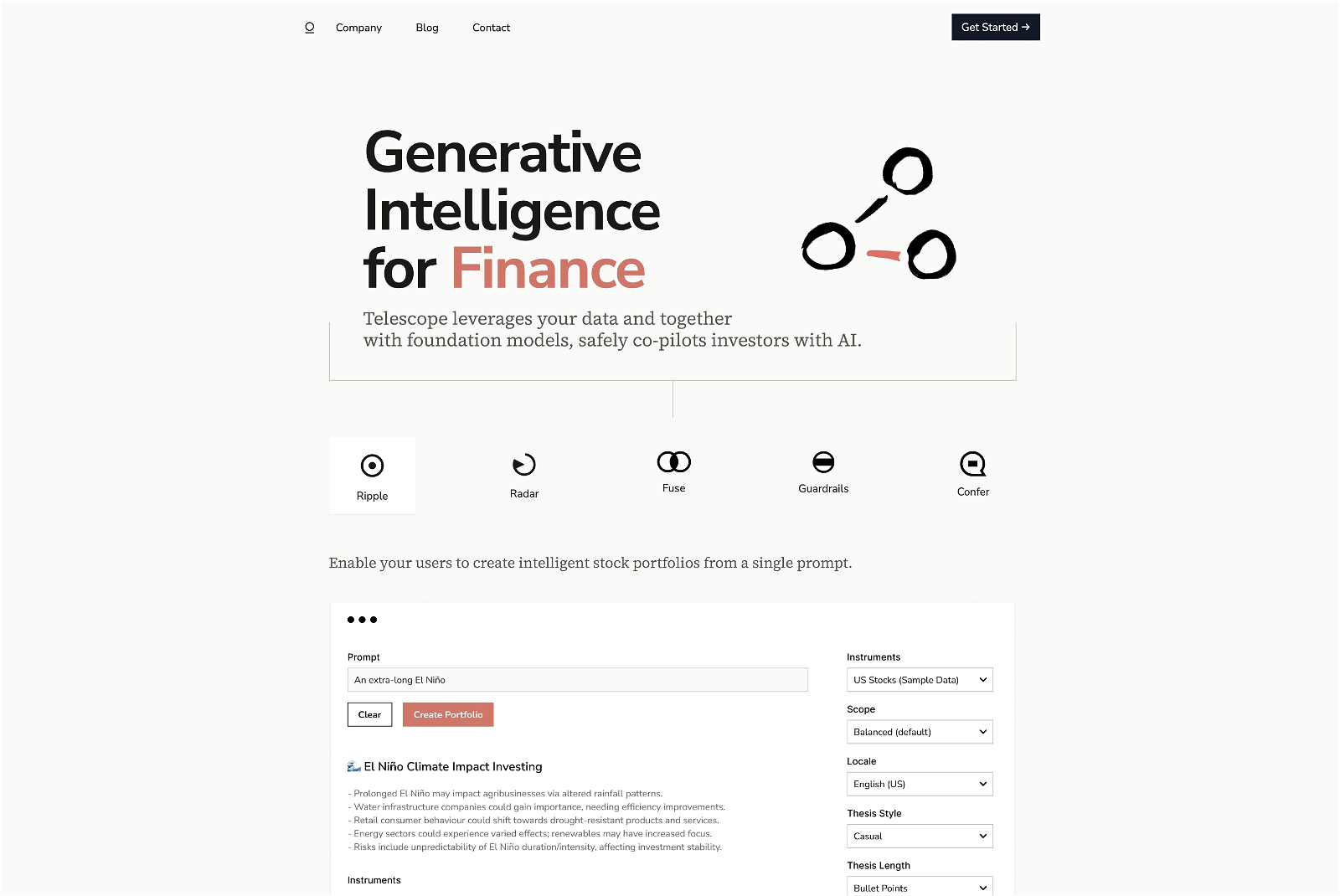

Telescope

Telescope is an AI tool specifically designed for finance companies, aiming to facilitate the delivery of high-quality AI applications in the financial sector. It offers various features such as portfolio creation, investment discovery, and generating insights. The tool recently introduced Telescope Radar, which focuses on unpacking investor personas using AI.

Telescope works seamlessly with broker apps, hedge funds, publishers, and startups, providing a generative AI architecture to enhance the user experience on their platforms. It offers three foundation products: Ripple, Radar, and Fuse. Ripple enables the creation of intelligent stock baskets based on a single theme or future event, eliminating friction between ideas and trades. Radar provides recommendations for portfolios or single stocks by constructing AI-generated personas, offering highly relevant trading suggestions to users. Fuse allows users to create their own content in a brand-specific tone and gather unique data on financial instruments.

For developers, Telescope offers a simple and seamless API integration to accelerate the development process. The tool also includes a flexible investment engine that allows users to design their own meta-model and match it against their datasets.

Telescope’s AI capabilities empower users to view the future and generate investment ideas from prompts or themes. It utilizes AI-driven stock selection to convert themes into actionable investment opportunities. With a focus on hyper-personalization, Telescope enables more trades and higher user engagement, resulting in increased conversions and retention rates. Testimonials from real investors showcase the tool’s positive reception within the industry.