ArkiFi

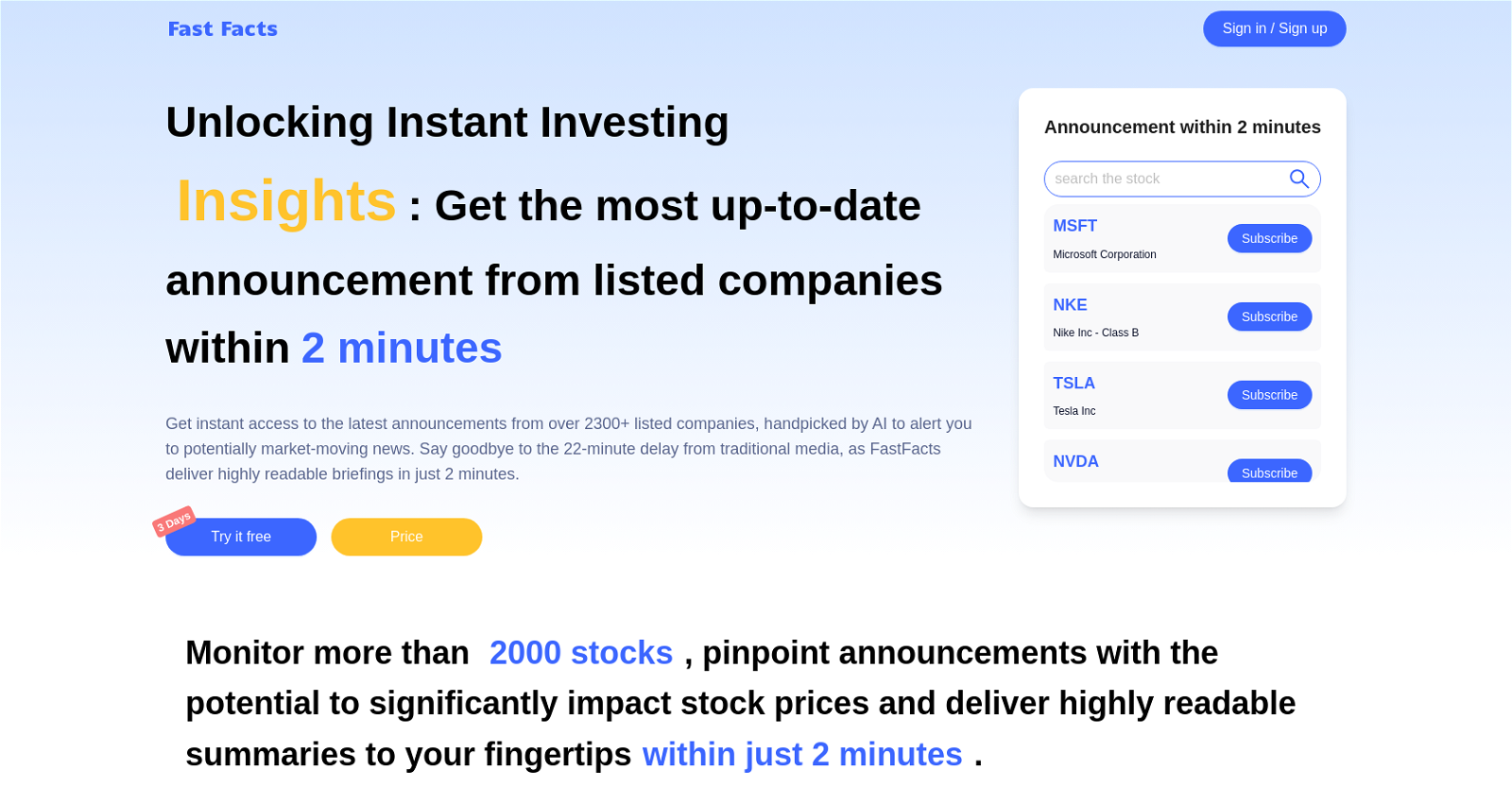

ArkiFi is a finance workflow automation tool that utilizes generative AI to revolutionize the finance industry. It offers cross-platform functionality, allowing users to make decisions faster and more accurately. By automating mechanical work, ArkiFi enables finance professionals to focus on strategic thinking and innovation, saving valuable time.

One of ArkiFi’s key features is its unique and proprietary architecture, which ensures deterministic output that never produces false or made-up information (“hallucination”). This distinct attribute instills trust in the results generated, making it an unparalleled tool for enterprises. The tool also provides the ability to automate grind work, such as formatting and debugging, in a single step. This further increases productivity by streamlining repetitive tasks.

ArkiFi aims to disintermediate human labor in advanced finance by empowering professionals with the power of a digital financial analyst. It frees them from manual model building in spreadsheets, allowing them to strategize, innovate, and generate alpha. Currently, ArkiFi has marquee financial institutions as initial customers and is working on a partnership with one of the world’s largest tech companies for distribution.

The company has raised significant capital from top-tier venture and angel investors, forming a world-class team. ArkiFi is actively hiring for various roles, including software engineers and AI engineers, as it focuses on building a generational company that redefines work in the finance industry.