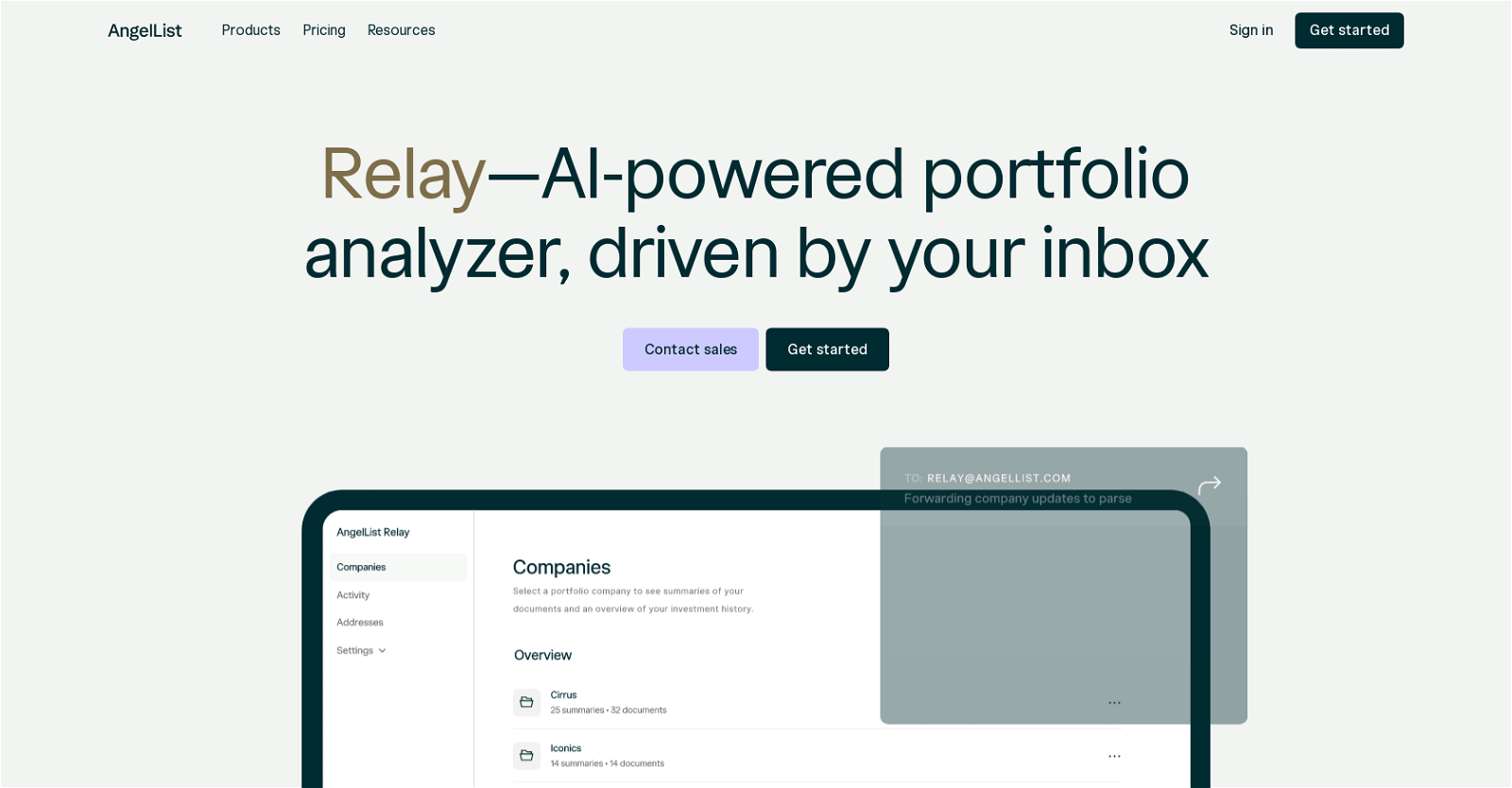

Relay

AngelList Relay is an AI-powered tool that helps users manage and analyze investment documents and company updates. By simply forwarding an email, Relay is able to extract key details from investment documents and unstructured investor updates. This includes information such as pay-to-play provisions, revenue metrics, burn rate, and more. Users receive an AI summary with the extracted data via email, typically within five minutes.

Relay offers document management capabilities, allowing users to access all historical portfolio company updates and investment documents directly in the tool. Documents are organized by company, year, and month, with the ability to bulk download them.

The tool also creates a portfolio tracking dashboard that combines structured investment data, AI summaries, and historical documents from emails. This helps users identify insights, track performance of portfolio companies, and craft investor updates for LPs.

Relay includes team permissioning and access features, ensuring that relevant stakeholders, both internal and external, have access to investment documents and key insights. The tool allows for multi-level team permissioning, granting different levels of access to different team members.

Users of Relay have praised its ability to transform unstructured data into a clear, actionable overview, providing value by organizing information that would otherwise be buried in email inboxes.

Relay offers different pricing plans, starting with a free tier that includes limited parsing capabilities, and higher tiers with increased parsing limits, unlimited team members, and additional features such as audit support and LP facing updates.

Relay is designed to handle a variety of investment documents, including SPAs and SAFEs, and currently supports parsing of terms related to these documents. The tool can also parse various terms and data from company updates, such as annual revenue, burn per month, cash in bank, number of customers, and more.

User Personal Identifiable Information (PII) is managed in accordance with AngelList’s privacy policy, and Relay only receives the emails and documents that are sent to the Relay email address. Data is stored using AWS services, encrypted at rest and in transit, and compliant with SOC 2 regulations.