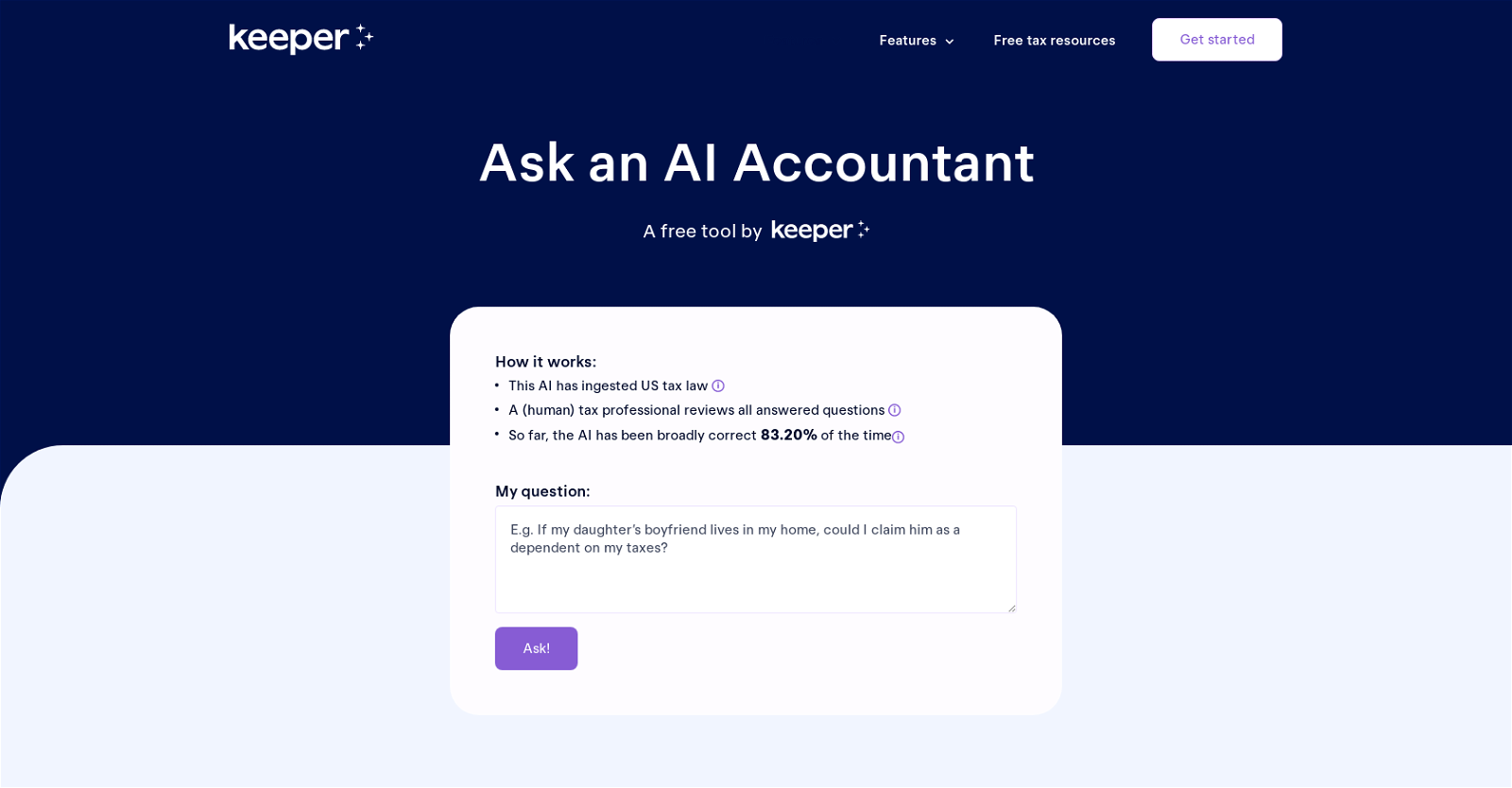

Keepertax

Keepertax is a free AI tool that allows individuals to ask tax-related questions and receive answers trained on the latest tax changes for 2023. The AI has ingested US tax law and federal and state tax legislation changes since 2021. Every few days, a human tax professional reviews all answered questions, providing users with correct or incorrect answers and any relevant comments.

As of now, the AI has been broadly correct 83.20% of the time; however, this accuracy score is expected to improve as more questions are reviewed by tax professionals. The AI accountant offers various features such as write-off detection, year-round tax bill/refund estimations, tax bill prediction, and tax filing through the phone with the IRS and State.

Users can also chat with an assigned tax assistant for professional tax help. The AI answers are not considered tax advice, and users must consult a tax professional before making any financial decisions. Nevertheless, it is a useful tool for individuals to gain insight and knowledge on tax-related questions before seeking professional help.

Users can filter through previously asked questions and reviews to find relevant information, making it easier to receive personalized tax solutions.