Have you ever faced challenges managing your credit? If so, you’re not alone. Many of us find the world of credit scores, bills, and cards confusing. But what if there was a tool that could make all of this simpler? Enter Cred AI, a fresh face in the credit world that promises to make things easier.

Now, you might wonder, “What’s so special about Cred AI?” Well, it’s not just another credit card or a fancy app. It’s a system designed to help you with your credit in ways you might not have imagined. Think of it as a friend who’s always there to give you credit advice, remind you of bill payments, and even help boost your credit score.

But why is credit so important? Imagine wanting to buy a house or a car. Your credit score will play a big role in that. A good score can get you better deals and save you money. On the other hand, a bad score can make things tough.

In today’s world, where everything is fast-paced, we need solutions that are simple and effective. We don’t have the time to read lengthy manuals or attend credit seminars. We need something that fits into our busy lives and gives results.

In this review, We’ll see what it offers, how it works, and if it’s the right fit for you. So, whether you’re a credit newbie or someone looking to improve their score, stick around. This review might just have the answers you’re looking for.

Background and Overview:

The story of Cred AI begins with a simple idea: making credit management easy for everyone. In a world filled with complex terms, hidden fees, and confusing processes, Cred AI wanted to be different. They wanted to create a tool that anyone could use, no matter their credit knowledge.

At its core, it’s a platform designed to help you with your credit. But it’s more than just a tool; it’s a companion. With Cred AI, you get insights, reminders, and even automated features that work in the background to help improve your credit score.

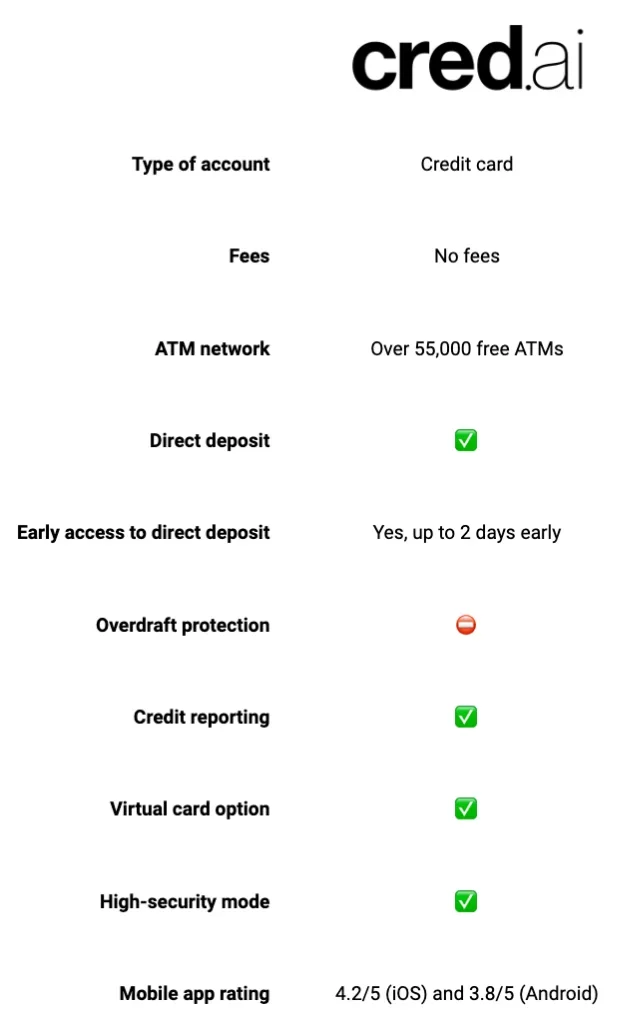

Now, this isn’t your typical credit card. The Unicorn card is designed to work with your bank account. When you use it, It sets aside money from your account. This ensures that you always have funds to pay off your card, helping you avoid late fees and interest.

But why the name “Unicorn”? Well, in the world of finance, a unicorn is something rare and special. And that’s what they aims to be. With its unique features and user-friendly approach, it truly stands out in the crowded credit market.

They understand that not everyone is a credit expert. Some of us might not even know what a credit score is. And that’s okay. You don’t need to be an expert. The platform does the heavy lifting for you, giving you more time to focus on what you love.

More and more people are discovering the benefits of this platform. From timely bill payments to improved credit scores, the positive stories are endless. And while no tool is perfect, Cred AI’s commitment to making credit easy is evident in everything they do.

Features and Functionality of Cred AI:

When we talk about tools that help with credit, what comes to mind? Maybe reminders, credit checks, or even rewards.

But Cred AI goes beyond that. Let’s explore the cool things it offers:

- Credit Score Help:

Imagine having a helper who always looks out for your credit score. That’s what Cred AI does. It has a special way to make your credit score better. How? It focuses on how you use your credit. This is a big part of your credit score. When you use the Unicorn card, Cred AI sets money aside in your bank. This money is used to pay your bills. And when bills are paid on time, your credit score gets better. It’s like having a safety net for your credit. - Bill Reminders:

Forgetting to pay a bill can be easy. We all have busy lives. But missing a bill can hurt your credit score. Cred AI has a solution. It pays your bills for you, on time. You don’t have to remember or worry. It’s like having a friend who always reminds you. - Credit Card Help:

Credit cards can be tricky. We use them, and then we get a bill. Sometimes, we might not have enough money to pay. Cred AI’s Unicorn card is different. When you use it, money is set aside from your bank. This money is used to pay the card bill. It’s a simple and smart way to use a card. - Rewards:

Who doesn’t like rewards? While Cred AI is all about helping with credit, they also think about fun stuff. They are always thinking of new things to add. So, in the future, there might be rewards or other cool features.

Now, let’s talk about some extra things Cred AI offers. They have a special card called the “Stealth card.” This card is for one-time use. It’s perfect for when you’re unsure about giving your card details. Like when ordering food over the phone.

Another cool thing is the “High-Security Mode.” This mode lets you pick when the card can be used. So, if you only want it to work from 9 am to 5 pm, you can do that.

Then there’s “Friend or Foe.” This lets you pick which shops can charge your card. If there’s a shop you don’t trust, you can block them. And if there’s a shop you love, you can always let them charge, even if you’re near your limit.

Cred AI also has a special offer. If you can’t pay your card, you can ask Cred AI for help. They might pay it for you. It’s like having a backup plan.

Lastly, It has a mobile app. This app lets you check things on the go. You can see your money, check your credit, and even find ATMs. And the best part? They have over 55,000 ATMs you can use.

In short, Cred AI is packed with features. It’s not just about credit. It’s about making life easier and better.

User Experience:

Using a new tool can be scary. We all worry about things being too hard or confusing. But with Cred AI, things are different. Let’s talk about what it’s like to use Cred AI.

Starting:

When you first start with Cred AI, you’ll notice it’s friendly. It’s like joining a new club where everyone wants to help. To begin, you link Cred AI to your bank. This might sound hard, but it’s easy. They guide you step by step. And if you have more than one bank, that’s okay. You can link them all.

Once linked, Cred AI checks a few things. They look at your bank details to decide your Unicorn card limit. But don’t worry, they don’t judge. They just want to help. And the best part? They don’t do a hard check on your credit. So, starting with Cred AI won’t hurt your credit score.

Using the App:

Cred AI has an app for phones. This app is like a magic window into your credit world. With a few taps, you can see everything. Your money, your credit score, and even your card details.

The app is colorful and easy to use. Big buttons, clear words, and helpful tips. It’s like a friendly guide always ready to help. And if you’re out and about, the app can help you find ATMs. With over 55,000 ATMs, you’re never far from one.

The Unicorn Card:

Using the Unicorn card is fun. It’s like any other card but smarter. When you use it, Cred AI sets money aside. This money is used to pay the card bill. It’s a smart way to make sure you always have enough.

And the card has some cool tricks. Like the “Stealth card” for one-time use. Or the “High-Security Mode” to pick when the card works. And if you have a favorite shop, you can always let them charge with “Friend or Foe.”

Getting Help:

Sometimes, we all need a little help. And Cred AI is always there. They have a team ready to answer questions. Whether it’s about the app, the card, or credit in general, they’re there.

You can call, email, or even chat with them. They’re friendly and know a lot about credit. It’s like having a credit expert as a friend.

Learning with Cred AI:

Cred AI is not just about tools. It’s also about learning. They want to help you understand credit. So, they have tips, guides, and even news. With Cred AI, you’re always learning.

In short, using Cred AI is a joy. It’s easy, fun, and helpful. They’ve thought of everything to make credit simple. From the app to the card, everything is designed with you in mind.

Credit Score Monitoring:

Credit scores. We hear about them a lot. But what are they? And why are they important? Let’s find out.

What is a Credit Score?

Think of a credit score as a report card for your money. It tells people how good you are with money. A high score means you’re good. A low score means you might need some help.

Why is it Important?

A credit score is like a key. It can open doors for you. Want a new car? A good credit score can help. Dreaming of a house? Your credit score matters. Even for small things, like a phone plan, your score plays a role.

How Does Cred AI Help?

Cred AI is like a coach for your credit score. It helps in many ways:

- Understanding Your Score:

Cred AI doesn’t just show your score. It helps you understand it. With clear words and simple charts, you can see what’s good and what needs work. - Making Your Score Better:

Cred AI has smart tools to boost your score. The Unicorn card is one. When you use it, Cred AI sets money aside. This ensures you pay on time. And paying on time is good for your score. - Keeping You Safe:

Mistakes can hurt your score. Like missing a bill or using too much credit. Cred AI watches out for these. It reminds you of bills and helps you use credit wisely. - Checking Your Score:

With Cred AI, you can check your score anytime. And the best part? Checking doesn’t hurt your score. So, you can check as much as you like.

Your credit score is a big deal. It can help you or hurt you. But with Cred AI, you’re not alone. They’re there to help, guide, and support. With their tools, tips, and team, you can make your score the best it can be.

Bill Payment Reminders :

Bills. We all have them. And sometimes, they can be easy to forget. But missing a bill can be a problem. It can hurt your credit score and cost you money. So, how can we remember to pay on time?

Why Are Bills Important?

Bills are like promises. When you use a service or buy something, you promise to pay. And keeping promises is good. It shows you’re responsible. But if you forget or can’t pay, it can be a problem. Late fees can add up. And your credit score can go down.

How Does Cred AI Help?

Cred AI is like a helpful friend. It reminds you of bills and even pays them for you. Here’s how:

- Friendly Reminders:

It knows when your bills are due. And it sends you reminders. These reminders are friendly and clear. They tell you how much to pay and when. So, you’re always in the know. - Automatic Payments:

You can set up automatic payments. This means Cred AI pays your bills for you. It’s like having a helper who always remembers. And the best part? You don’t have to worry about late fees. - Easy Setup:

Setting up bill reminders is easy. You link your bills to Cred Cards. And that’s it. It takes care of the rest. It checks your bills, sends reminders, and pays on time.

Paying bills on time is good. But there are more ways to save. With Cred AI, you can see all your bills in one place. This helps you plan and budget. And if you see a bill that’s too high, you can check it. Maybe there’s a mistake. Or maybe you can find a better deal.

Bills are a part of life. But with Cred AI, they’re easier to manage. With reminders and automatic payments, you’re always on track. And with extra tips and tools, you can save even more. So, if you want to be on top of your bills, Cred AI is the way to go.

Credit Card Management:

Credit cards. They’re small, shiny, and powerful. With them, we can buy things, earn rewards, and even build credit. But they can also be tricky. If not used right, they can lead to debt and stress. So, how can we use them smartly?

Why Use Credit Cards?

Credit cards are like magic wands. With a swipe, you can get what you want. And if used right, they can help you. You can build credit, earn rewards, and even get discounts. But they come with responsibility. You need to pay back what you spend. And if you’re not careful, you can end up in debt.

How Does Cred AI Help?

Cred AI is like a guide for your credit cards. It helps you use them the right way. Here’s how:

- Smart Spending:

With Cred AI, you can see all your spends. This helps you know where your money goes. And if you spend too much, Cred AI will tell you. It’s like having a coach who helps you spend smartly. - Safe Payments:

Cred AI has a special card called the Unicorn card. When you use it, money is set aside. This money is used to pay your card bill. It’s a smart way to make sure you always have enough. - One-Time Use Cards:

Sometimes, we worry about sharing our card details. Like when shopping online. Cred AI has a solution. They have a card called the “Stealth card.” It’s for one-time use. So, you can shop without worry. - Control Your Card:

With Cred AI, you’re in control. You can pick when your card works. And you can even pick where it works. If there’s a shop you don’t trust, you can block them. It’s all in your hands.

Using credit cards right is a skill. And Cred AI has some tips. Always check your spends. This helps you know where your money goes. Try to pay the full bill every month. This avoids interest and helps your credit score. And always be safe. Don’t share your card details unless you trust the place.

Rewards and Cashback Tracking

Who doesn’t like getting something extra? With credit cards, we often get rewards and cashback. It’s like a little gift for using the card. But tracking these rewards can be hard. How do we know what we’ve earned? And how do we use it? ![]()

What are Rewards and Cashback?

Think of rewards and cashback as thank you gifts. When you use your credit card, you get points or cashback. These can be used for gifts, discounts, or even cash. It’s a way for card companies to say thank you for using their card.

How Does Cred AI Help?

Cred AI is like a treasure hunter for rewards. It finds, tracks, and even helps you use them. Here’s how:

- Finding Rewards:

With Cred AI, you can see all your rewards in one place. It’s like a treasure chest of points and cashback. You can see what you’ve earned and what you can get. - Tracking Spending:

To earn rewards, you need to spend. But how much? And where? It shows you where to shop to get the most rewards. It’s like having a map to treasure. - Using Rewards:

Earning rewards is fun. But using them is even better. With Cred AI, you can see all the cool things you can get. From gifts to discounts to cash, it’s all there. And using them is easy. With a few clicks, you can enjoy your rewards.

Rewards are fun. But to get the most, you need some tips. Always check Cred AI before shopping. They might have deals or offers. Try to use your card at places that give more rewards. And always check your rewards. They can expire, so use them before they’re gone.

Data Security and Privacy:

In today’s world, safety is a big deal. Especially when it comes to our personal details. We hear stories of data leaks and hacks. So, when using a tool like Cred AI, how do we know our details are safe? Let’s find out.

Why is Data Safety Important?

Our personal details are like keys. They can open doors to our lives. If someone gets our details, they can misuse them. They can steal our identity, money, and even harm our credit. So, keeping these details safe is super important.

How Does Cred AI Keep Data Safe?

Cred AI is like a guard for your details. They use many ways to keep them safe. Here’s how:

- Strong Walls:

Cred AI uses special walls called encryption. These walls turn your details into codes. So, even if someone tries to see, they can’t understand. - Safe Payments:

When you pay with Cred AI, your card details are safe. They use one-time use cards. So, even if a shop’s system is hacked, your details are safe. - User Control:

With Cred AI, you’re in control. You can pick when and where your card works. If you feel a place is not safe, you can block it. - Regular Checks:

Cred AI always checks for dangers. They have a team that looks for threats. If they find one, they act fast to keep your details safe.

Our personal details are precious. And with Cred AI, they’re safe. They use strong walls, safe payments, and regular checks. So, if you want a tool that’s not just helpful but also safe, Cred AI is the way to go.

Pros and Cons:

Everything has its good sides and not-so-good sides. Even our favorite things. Cred AI is no different. It has many cool things, but also some things to think about. Let’s explore both.

The Good Stuff (Pros):

- Friendly Helper:

Cred AI is like a friend who knows a lot about credit. It helps, guides, and even teaches. With it, credit becomes easy and fun. - Smart Tools:

Cred AI has many tools. Like the Unicorn card that sets money aside. Or the Stealth card for safe shopping. These tools make credit simple and safe. - Rewards and More:

Who doesn’t like gifts? With Cred AI, you can earn rewards and cashback. And the best part? Cred AI helps you track and use them. - Safety First:

With Cred AI, your details are safe. They use strong walls, safe payments, and regular checks. So, you can use Cred AI without worry. - Always Learning:

Cred AI is not just about tools. It’s also about learning. They have tips, guides, and news. So, you’re always learning and growing.

Things to Think About (Cons):

- New Kid on the Block:

Cred AI is new. And like all new things, it’s still learning. So, there might be some small issues. But they’re always working to make things better. - Not for Everyone:

Cred AI is great for many. But not for all. If you’re a credit expert, you might want more. Or if you don’t use credit cards, it might not be for you. - Needs a Connection:

To use Cred AI, you need to link your bank. This is easy and safe. But if you’re not comfortable, it might be a thing to think about.

Cred AI has many good sides. It’s friendly, smart, and safe. But it also has some things to think about. It’s new and might not be for all. But for many, it’s a great tool. It makes credit easy, fun, and safe.

Customer Support and Community

We all need a little help sometimes. Whether it’s a question, a problem, or just a chat. Good support can make a big difference. And with Cred AI, you’re never alone. Let’s see how they support their users.

Why is Support Important?

Support is like a safety net. When we have a problem or question, it catches us. It helps us move forward without worry. And in the world of credit, good support is key.

How Does Cred AI Support Users?

Cred AI is like a friend who’s always there. They have many ways to help and support. Here’s how:

- Friendly Team:

Cred AI has a team of helpers. They’re friendly, smart, and ready to help. Whether it’s a call, email, or chat, they’re there. - Clear Guides:

Cred AI knows credit can be tricky. So, they have guides. These guides are simple and clear. They help you understand and use credit the right way. - Active Community:

Cred AI users are like a big family. They chat, share, and even help each other. Whether it’s a tip, a story, or a question, the community is there.

Good support is a two-way street. While Cred AI does its part, we can do ours. Always be clear when asking for help. This makes it easier to get the right answer. And always be kind. A little kindness can go a long way.

Final Thoughts:

We’ve walked a long path. From its humble beginnings to its powerful features, we’ve seen it all. So, as we stand at the end of our journey, what’s the final say?

A Tool for Today:

Times change. And so do our needs. In today’s fast-paced world, we need tools that keep up. And Cred AI does just that. It’s modern, smart, and always evolving. It’s a tool for today and tomorrow.

More Than Just Features:

Many tools have features. But Cred AI has more. It has a heart. It cares about its users. From its friendly support to its active community, it’s always there. It’s not just a tool; it’s a partner.

Safety in a Digital World:

The online world can be scary. We hear stories of hacks and leaks. But with Cred AI, we can be at peace. Its strong walls, safe payments, and user controls keep us safe. It’s a beacon of safety in a digital storm.

Always Growing:

Cred AI is like a plant. It’s always growing. With user feedback and updates, it’s always getting better. So, while it’s great today, it’ll be even better tomorrow.

As we wrap up, one thing is clear. Cred AI is special. It’s more than just features and tools. It’s a friend, a guide, and a protector. It makes the complex world of credit simple and fun. And with its constant growth, it’s set to soar even higher. So, if you’re on the fence, give Cred AI a try. And join the many who’ve found a better way to credit.

Yes, it's safe. Cred AI uses strong walls called encryption to keep your details safe. They also have safe payments and regular checks. So, you can use Cred AI without worry. Cred AI has different plans. Some are free, and some have a cost. But all plans are clear with no hidden fees. You can pick what fits your needs and budget. Yes, it can. Cred AI has tools and guides to help you understand and use credit. With its tips and insights, you can work to improve your score. With Cred AI, you can earn rewards and cashback. You can see what you've earned and what you can get. Cred AI also helps you track and use your rewards. While Cred AI is great for credit cards, it's not just for them. It also helps with other credit tools and topics. So, whether you have a card or not, Cred AI can help. Cred AI is special. It's not just a tool; it's a partner. It's friendly, smart, and always growing. And with its mix of features, safety, and support, it stands out.FAQs

Is Cred AI safe to use?

How much does Cred AI cost?

Can Cred AI help me improve my credit score?

How does Cred AI's rewards system work?

Is Cred AI only for credit cards?

Why should I pick Cred AI over other tools?

You May Also Like

10 Best AI face creator To Craft Faces with a Click

10 Best AI Image Creator Tools: Design Beyond Limits

10 Best AI music creator: The Future Sound of Music

10 must read Powerful Expert AI Content Marketing Tools: Ultimate Guide

10 Powerful and Best AI Tools for Developers: Expert Guide

10 Ultimate Trending AI Tools: Your Perfect AI Guide